*Says Buhari administration will continue to implement policies to create more jobs, grow the economy

“Creating an enabling environment for business is another must-do. We have pursued this goal aggressively since 2016, and I’m pleased to note that we’re already started seeing the results. We have reduced business registration times, we’ve implemented a functioning Visa on Arrival system, launched an online system for filing taxes, among other reforms. By dismantling the bureaucratic obstacles in the way of businesses and investors, we are hoping to unleash the full potential of private enterprise; the kind of enterprise that creates jobs, that grows the economy, and produces future tax revenues for the government.

“This conversation about creating financially viable states should therefore be viewed through the lens of the medium to the long term. There will always be the temptation to prioritize raising Internally Generated Revenue (IGR) at all costs. If this is done in a manner that stifles today’s entrepreneurs and investors, then clearly there will be a great price to pay down the line.

“So, it is clear that Governors have to think beyond four or eight year cycles. There must be a commitment to laying a foundation that our successors will build on, and for successors to be ready to build on foundations laid.

“One of the challenges with governance in Nigeria today is that penchant for dismantling or dismissing everything inherited. President Buhari insisted when we assumed office that we must ensure the completion of projects started but abandoned or uncompleted by previous governments before starting new ones. Our problem, of course, in our country, is not in new ideas or starting projects, it is the lack of rigour and discipline to complete projects and to maintain them.” – Vice President

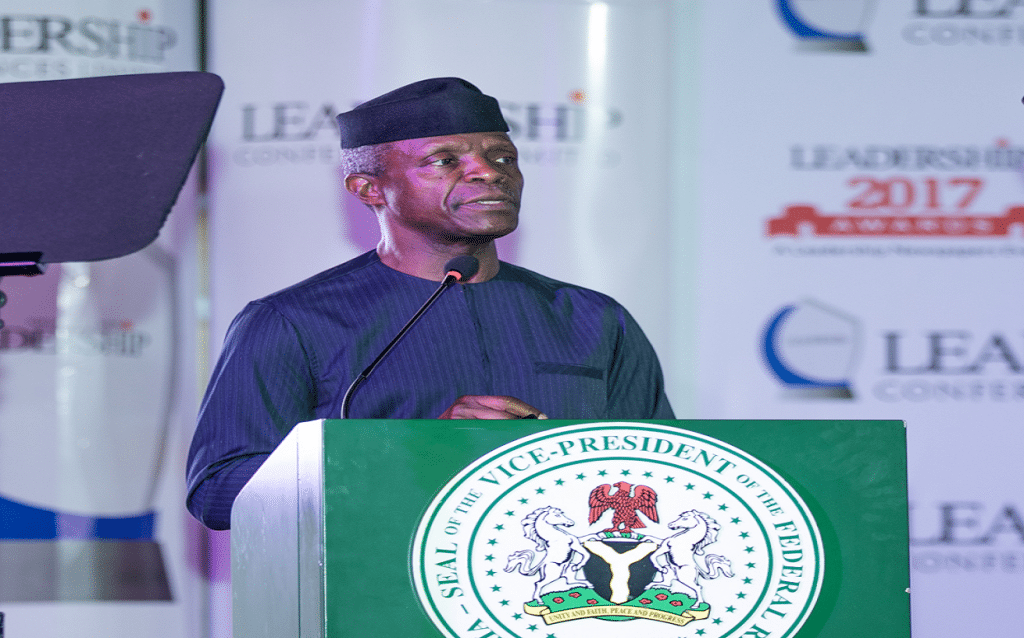

KEYNOTE ADDRESS BY HIS EXCELLENCY, PROF. YEMI OSINBAJO, SAN, GCON, VICE PRESIDENT, FEDERAL REPUBLIC OF NIGERIA, AT THE LEADERSHIP NEWSPAPERS AWARDS AND CONFERENCE 2018, THEMED “TOWARDS FINANCIALLY VIABLE STATE GOVERNMENTS”, HELD AT THE INTERNATIONAL CONFERENCE CENTRE, ABUJA, ON THURSDAY, 24th MAY, 2018.

PROTOCOL

On the 9th of May 2018, while speaking at the opening ceremony of the 20th conference of the Chartered Institute of Taxation of Nigeria, I had occasion to refer to the remarkable achievements of Chief Obafemi Awolowo, as Premier of the then Western Region of Nigeria, from 1954-1960.

The Western region is what today constitutes Oyo, Ogun, Ondo, Ekiti, Osun, parts of Kwara and Kogi, parts of Edo and Delta; Lagos, as far as Jibowu, some parts of Ikeja and Agege. The six year period of the Awolowo government is often cited as one of the most progressive of any government in the developing world. Some of the major accomplishments of that government include the University of Ife (now Obafemi Awolowo University); the 26-storey Cocoa House, Ibadan, then, of course, an architectural wonder; Western Nigeria Television Authority, the first in Africa; the Ikeja industrial estate, several farm settlements, the Airport Hotel, Ikeja, several other industrial establishments – Oodua Textile Industries, Ado Ekiti, Okitipupa Oil Palm Mills, Oluwa Glass in Ifon, the ceramics industry there, Ire Ekiti Brick Industry, a network of roads across the region.

But by far the most significant of these achievements is the Free Universal Primary Education. In 1952, when the scheme was proposed, 381,000 children, about 30% of children at the time, were enrolled in school. By 1955, when the scheme took off, 811,432 children were enrolled. And the number continued to grow. The Government devoted as much as 41.2% of the 1958/59 recurrent budget to Education, one of the highest in the world at the time. At the same time, the Region nurtured a vibrant civil service and judicial system which is widely acknowledged as a model, even today.

So how were Awo’s phenomenal achievements possible? There was no oil revenue, no Federal revenue. In fact, the Western Region government gave revenue to the federal government.

How did they achieve financial viability? Mostly it was taxes and revenues from Agriculture, especially cocoa, and some from mineral resources. Free education, which was audaciously launched by that Government, was directly on the back of income taxes, a capitation or poll tax was imposed by the Western Region Government mainly to fund free education, despite much opposition and protests. But with Military rule from 1967, and oil money, every one forgot about taxes. The Federal Government gave everyone an allocation.

So today, the States in the old Western Region, aside from Lagos, do not earn enough in taxes or anything else to pay salaries, let alone do major capital projects. Without federal allocation most cannot survive. Indeed, the problem of the States is the same as that of the Federal Government; a complete reliance on a source of revenue that is extractive, and so requires no creativity or productivity whatsoever.

Most resource-rich nations and sub-nationals in the developing world end up being poor and financially unviable because making easy revenues from the extraction of resources is habit-forming; a habit of easy money without effort, few jobs are created because there is no value added. So Japan, Singapore and South Korea with no significant natural resources are some of the most successful economies, because they create enough jobs for most of their population. Why is that so? Because financial viability is based on innovation and productivity; productivity means adding value, not necessarily possessing the resources, but adding value to whatever resources, even if you have to import the resources.

So the consumers of crude oil, like those countries I’ve mentioned, earn more than producers of oil, because they add value to the crude oil they import by processing it and converting it to petrochemicals in some cases, often selling these improved products to the oil producers at more profit.

I have drawn my examples from the experiences of Nation States to illustrate the problems of the unviability of States, because I think a lot of the answers to the challenge of creating financially viable state governments are the same as the problems of creating a financially viable countries or Nation State. So the prescriptions would always be similar. Many of the same principles that work for a national government will also work for a subnational government.

So, for the Federal government, one of our priorities has been diversifying our revenue base. When we assumed office in 2015, there were only about 14 million taxpayers of the almost 70 million economically active Nigerian citizens. Indeed, of the 943 persons who pay over N10 million in assessed taxes in Nigeria, 941 of them live in Lagos, the other two live in Ogun State. The question you have to ask is: how does any country survive when only a fifth of those who should be paying taxes actually pay them. And so we set out to implement the needed reforms, including our Tax Amnesty, which is being done in partnership with the State Tax Authorities. Today, we have added nearly 6 million tax payers. It is taxes usually that would pay for development.

Secondly, is a focus on agriculture, and especially value-adding by processing along the Agro-allied value chain, creating jobs, reducing imports and exporting more. Since all the land is in the States anywhere, except, of course, for the Federal Capital Territory, the States that have created the most jobs are those that focused on agriculture and the value chain. Rice-producing States, for example, have witnessed a tremendous rise in the prosperity of their people. So states like Kebbi, Jigawa states have noticed a significant improvement in the earnings of farmers and of people, and certainly more farmers

Thirdly, creating an enabling environment for business is another must-do. We have pursued this goal aggressively since 2016, and I’m pleased to note that we’re already started seeing the results. We have reduced business registration times, we’ve implemented a functioning Visa on Arrival system, launched an online system for filing taxes, among other reforms. By dismantling the bureaucratic obstacles in the way of businesses and investors, we are hoping to unleash the full potential of private enterprise; the kind of enterprise that creates jobs, that grows the economy, and produces future tax revenues for the government.

On account of these reforms, the World Bank recognized Nigeria as one of the top 10 most improved economies in the world, and the International Monetary Fund (IMF) cited the business climate reforms as a major contributor to lifting the economy out of the recession last year.

We are actively collaborating with State Governments, under whose oversight some reform areas, like land acquisition and property registration, fall. Very recently, Lagos and Kano States – two of the largest subnational economies in Nigeria – launched small claims courts to focus on SME litigations that do not exceed N5 million. Both Lagos and Kano have clearly recognized the place of a good business environment for attracting investments and thus improving their revenues.

Similarly, Ogun State’s industrial parks have attracted businesses and produced taxes which have moved the State to number four in revenue generation. Abia and Anambra are moving confidently to becoming manufacturing hubs, especially for steel fabrications, shoes and clothing. Jigawa has established a seedling reduction plant. Now it’s beginning to sell improved seedlings to many other states. States must behave like countries and the dynamics of success are changing. And I’ll come back to this point shortly.

Indeed we are heading towards a time when our States will be competing very actively against one another for big-ticket investments, as is already happening elsewhere in the world.

Recently, Amazon, one of the most valuable companies in the world, wanted to open a new headquarters, and they asked cities around America to pitch. About 200 cities submitted bids and Amazon announced a shortlist of 20 cities a few months ago. A final announcement, of the winning city is now pending. Now, why is this important? The city that will host Amazon HQ2 will enjoy more than $5 billion in construction investment alone, not to talk of the tens of thousands of direct and indirect jobs that Amazon will bring to the city, and the multiplier effects on the local transportation, hospitality, the entertainment industries, and the additional investment that other companies will bring because of Amazon’s presence in that city.

Now think about what this development might mean for Nigeria soon, when companies make important decisions about siting their offices primarily based on how easy a State makes it for people to do business in it. States that make it easy for investors to acquire land, register property, pay taxes, and to access broadband Internet will be the clear winners, while States that make these things difficult or impossible will languish as the world carries on without them.

If all of this sounds very theoretical, consider that Information and Communications Technology, which, of course, does not require natural resources, contributes about a tenth of Nigeria’s GDP already, up from negligible levels less than two decades ago. And according to the Nigerian Communications Commission (NCC), the telecoms sector has attracted US$70 billion in Foreign Direct Investment in the last 16 years. That’s the size of the economic potential that we are talking about. And they can take their business anywhere once the infrastructure is right.

The access to broadband issue is worth highlighting as an example of how States can make decisions that can make or mar their economic future. This is an issue that was frequently debated at the National Economic Council (NEC), which, of course, as you know, brings together State Governors and Federal officials, and which I have the privilege to Chair. The argument was that States should not charge prohibitive prices for installing fibre optic cables; that our goal as a country at this time should be covering the entire country with broadband as an investment into our future.

The alternative, of course, is for a State Government to look only at how it can maximise today’s revenues by charging exorbitant fees for broadband installation. This would be a case of penny-wise-pound-foolish; short-term gain at the expense of the future potential and profit. In the future – and that future is right here on our doorsteps. Our States will thrive or suffer on the strength of things like how fast and cheap the Internet is.

Thankfully, NEC resolved in favour of low standard fees, but this would not include the cost of damage to roads. But the states also agreed to ensure that roads being built must have ducts to prevent costly damage to roads when cables for various types of infrastructure and services are being laid.

This conversation about creating financially viable states should therefore be viewed through the lens of the medium to the long term. There will always be the temptation to prioritize raising Internally Generated Revenue (IGR) at all costs. If this is done in a manner that stifles today’s entrepreneurs and investors, then clearly there will be a great price to pay down the line.

So, it is clear that Governors have to think beyond four or eight year cycles. There must be a commitment to laying a foundation that our successors will build on, and for successors to be ready to build on foundations laid.

One of the challenges with governance in Nigeria today is that penchant for dismantling or dismissing everything inherited. President Buhari insisted when we assumed office that we must ensure the completion of projects started, but abandoned or uncompleted by previous governments before starting new ones. Our problem, of course, in our country, is not in new ideas or starting projects, it is the lack of rigour and discipline to complete projects and to maintain them.

One of the reasons why Lagos State is possibly the most successful subnational economy is the continuity in the implementation of a plan. Each governor in Lagos has followed the plan in financial reform, in land reform, laid out by the Tinubu administration, so also in infrastructure development. The BRT was started in 2005 or so. Then Governor Fashola completed and improved upon it, (Governor) Ambode finished off the Ikorodu one and has continued to expand the BRT. The rail project, which was largely begun by Fashola, is being completed by Ambode. The way of progress is by trying to follow through a plan and completing what has been started.

Even though the Treasury Single Account, TSA, was not our idea, we recognized its value and realized that the real challenge was the lacklustre implementation that it had suffered over the years. And so President Buhari issued his first Presidential Order mandating full compliance with the TSA. The closure of more than 20,000 commercial bank accounts that followed has resulted in monthly savings of N4 billion that would have gone on bank charges alone. That’s more resources for us to use for the benefit of Nigerians.

The Lagos-Kano standard gauge, Warri-Aladja rail, Second Niger Bridge, have always been in the pipeline. We have taken the concrete steps required to complete it. We raised the counterpart funding in the cases of those requiring loans, and made sure the contractors are getting the job done.

Financial viability is not just about earning more, it’s also as much about doing more with less, which is our mantra at the Federal level; making the little we have go as far as possible. How? By embracing fiscal prudence, debt management, controlling overheads, and so on.

But perhaps, most importantly, and this is the elephant in the room; stopping corruption, beginning with grand corruption. By that I mean that habit of simply converting money from the treasury to personal use and ownership. This is the stranger than fiction variant of corruption which seems to be a uniquely Nigerian phenomenon. Financial viability is impossible if the custodians of the finances want the money for themselves. Our States must think plan and act as countries, and why not?

Ten of Nigeria’s States with the highest GDPs have higher GDPs than over 15 African countries. In fact, I was saying the other day, that if you look at Rwanda, which is a country that is celebrated in Africa, the GDP of Lagos State is almost four times the size of Rwanda’s GDP.

Thinking like a country means planning like one. And I think that one of the most important things for states to do is to begin to think and plan like countries do. And we cannot wait for constitutional reforms that may be required for further devolution to the states. We must act whether or not there is this reform. In many cases, states have control of some of the resources that can make a tremendous difference in the way that they operate.

Let me thank my dear brother and friend and Chair of the Leadership Newspapers Group, Mr. Sam Nda-Isaiah for this opportunity to speak, and also to congratulate all the deserving award winners in advance.

Thank you very much and God bless.

Released by:

Laolu Akande,

Senior Special Assistant to the President (Media & Publicity)

Office of the Vice President

24th May, 2018

0 Comments