Background

In 2011 the Central Bank of Nigeria (CBN) decided to convert a portion of its external reserves into the Chinese currency, Renminbi (RMB). At that time Nigeria was one of the first countries in the world to do this. This policy decision was appropriate because:

• The RMB was becoming more of an international currency, given China’s expanding influence in global trade; and

• China is one of Nigeria’s largest trading partners. Indeed, as of end-2016, bilateral trade between both countries stood at about US$14.7 billion. In fact, imports from China accounted for 35 percent of total imports, with the second country (India) accounting for only 5.8 percent.

Currently, about 4.5 percent of Nigeria’s external reserves is denominated in Renminbi.

In further reflection of these realities, the Central Bank of Nigeria (CBN) decided to pursue a Bilateral Currency Swap Agreement with China’s Central Bank, the People’s Bank of China (PBOC) in order to broadly ease trade transactions between both countries by avoiding the use and/or influence of a third currency.

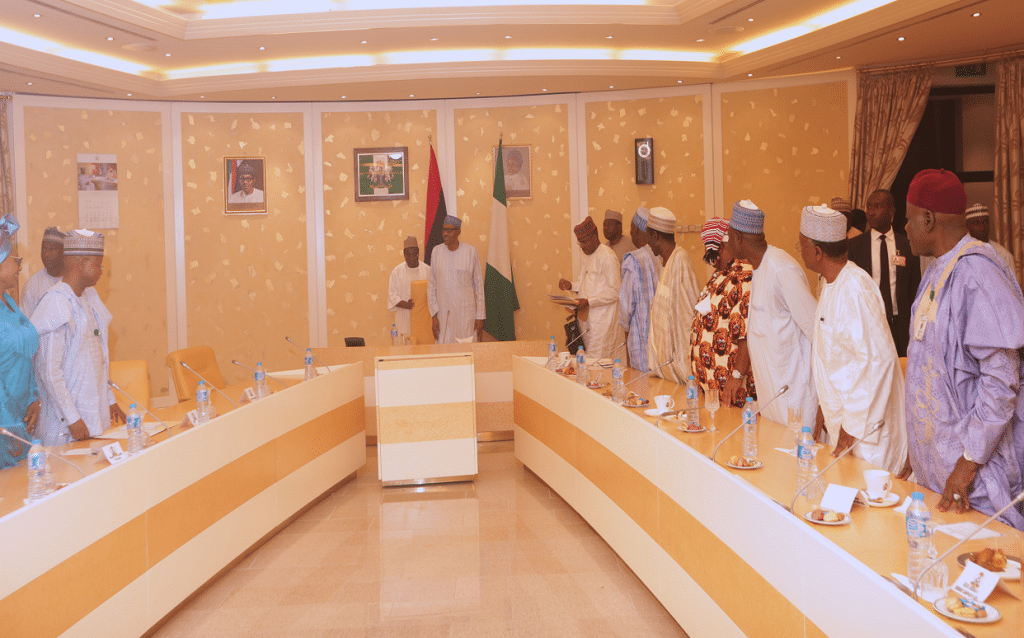

After more than two years of painstaking negotiations, this agreement was signed by the CBN and the PBOC on Friday 27 April 2018. Nigeria becomes the 3rd African country to have a Currency Swap Agreement with the People’s Bank of China.

How Will this Agreement Work?

It makes a certain amount of Renminbi available to the CBN and Naira equivalent available to the PBOC, using the 2014 Trade Balances between both countries.

The CBN will then make the Renminbi available to Nigerian banks, who can on that basis open Renminbi Letters of Credit (LC) for Nigerians wishing to do business with Chinese counterparties. This option (Renminbi-denominated transactions) is now available in addition to the current practice of exclusive use of US Dollars for such trades/transactions.

In effect, Nigerians buying goods from China can now pay in Renminbi, while Chinese importers of Nigerian goods can also pay in Naira; instead of in dollars. The incoming Renminbi from Chinese importers will go into the CBN’s Renminbi Reserves, and place it in a better position to honour its obligation to repay to China the RMB value of the Swap Facility when it is due.

The CBN will on its own part encourage Nigerians to use Renminbi to pay for imports from China, which should reduce the pressure on US dollars. Chinese Companies are also likely to eagerly take advantage of the opportunity to pay for imports from Nigeria in either currency.

The RMB would now also be available for prospective Foreign Direct and Foreign Portfolio Investors.

How much will the Chinese Swap Facility be worth?

The Swap Facility is valued at RMB15 billion, which is equivalent to about US$2.5 billion.

Why is the Renminbi important?

The Renminbi is one of the most widely used currencies in the world, on account of China’s status as the world’s largest exporter of goods to other countries.

Reflecting this reality, the currency has begun to earn the confidence of global markets. In October 2016, it was admitted by the International Monetary Fund (IMF) as the fifth member – joining the U.S. Dollar, Euro, Yen and Pound Sterling – of the basket of currencies that constitute the ‘Special Drawing Right’, the IMF’s supplementary international reserve asset. This implies that other countries can now hold the Renminbi as part of their Foreign Exchange Reserves.

When will the Swap Amount be due for repayment by Nigeria?

This agreement is valid for an initial period of three years, which the two banks can extend by mutual consent. Drawings can be reviewed severally within this three-year period.

Potential Benefits for Nigeria

• It will reduce demand for US Dollars, and as such, reduce the pressure on the Dollar- Naira Exchange Rate. Every Nigerian who does business in China, and whose suppliers agree to receive payment in Renminbi, can now pay in Renminbi, instead of the Dollar.

• Since Chinese importers of Nigerian goods can now, as part of this arrangement, pay for their imports in Renminbi, this arrangement has the potential of boosting Nigeria’s exports to China (currently Nigeria runs a large trade deficit with China), and therefore ultimately redressing the trade imbalance.

• It will increase the speed, volume and convenience of business transactions between Nigeria and China, and also help safeguard Nigerian businesses from the exchange unpredictability that arises when Naira-Renminbi transactions have to go through an intermediate conversion into USD.

How will Nigeria source the Renminbi to make this Agreement operational?

For a start, the Agreement provides for the PBOC to swap RMB16 billion in exchange for N720 billion from the CBN. To the extent that Chinese businesses pay for their imports from Nigeria with RMB, this stock will rise.

Source: Federal Government of Nigeria | statehouse.gov.ng

0 Comments